Index Ventures

(2025-11-14T08:48.146Z)

Perplexity Query

(2025-11-14T08:48

.146Z)

Question:

Write a comprehensive one-page article about "Index Ventures".

Model: sonar-pro

Index Ventures: Powering Global Innovation Through Venture Capital

Introduction

Index Ventures is a leading venture capital firm that invests in early to growth-stage technology companies, with a focus on fostering the most ambitious entrepreneurs worldwide.

[vim3se]

[jijc3o]

As a major force in the startup ecosystem, Index Ventures has played a pivotal role in shaping markets and advancing innovation, especially across Europe, the United States, and Israel.

[vim3se]

Main Content

Index Ventures, founded in Geneva in 1996 by Neil Rimer, David Rimer, and Giuseppe Zocco, operates from multiple global hubs—including London, San Francisco, New York City, Geneva, and Jersey.

[vim3se]

[jijc3o]

The firm’s origins trace to a family-run Swiss bond-trading business, which pivoted to tech investment as the digital revolution accelerated.

[vim3se]

By the early 2000s, Index Ventures had firmly established its reputation, expanding both its geographical reach and its focus on disruptive technology sectors.

[vim3se]

As a multi-stage investor, Index Ventures backs companies at the seed, early, and growth stages.

[t7xtku]

Its investment check sizes range widely (from ~$100,000 for pre-seed to $50 million for later-stage rounds), enabling flexibility and long-term partnerships with startups as they scale.

[jijc3o]

[t7xtku]

The firm is sector-agnostic but is best known for supporting high-growth technology, life sciences (prior to 2016), AI, fintech, consumer, and deeptech companies.

[t7xtku]

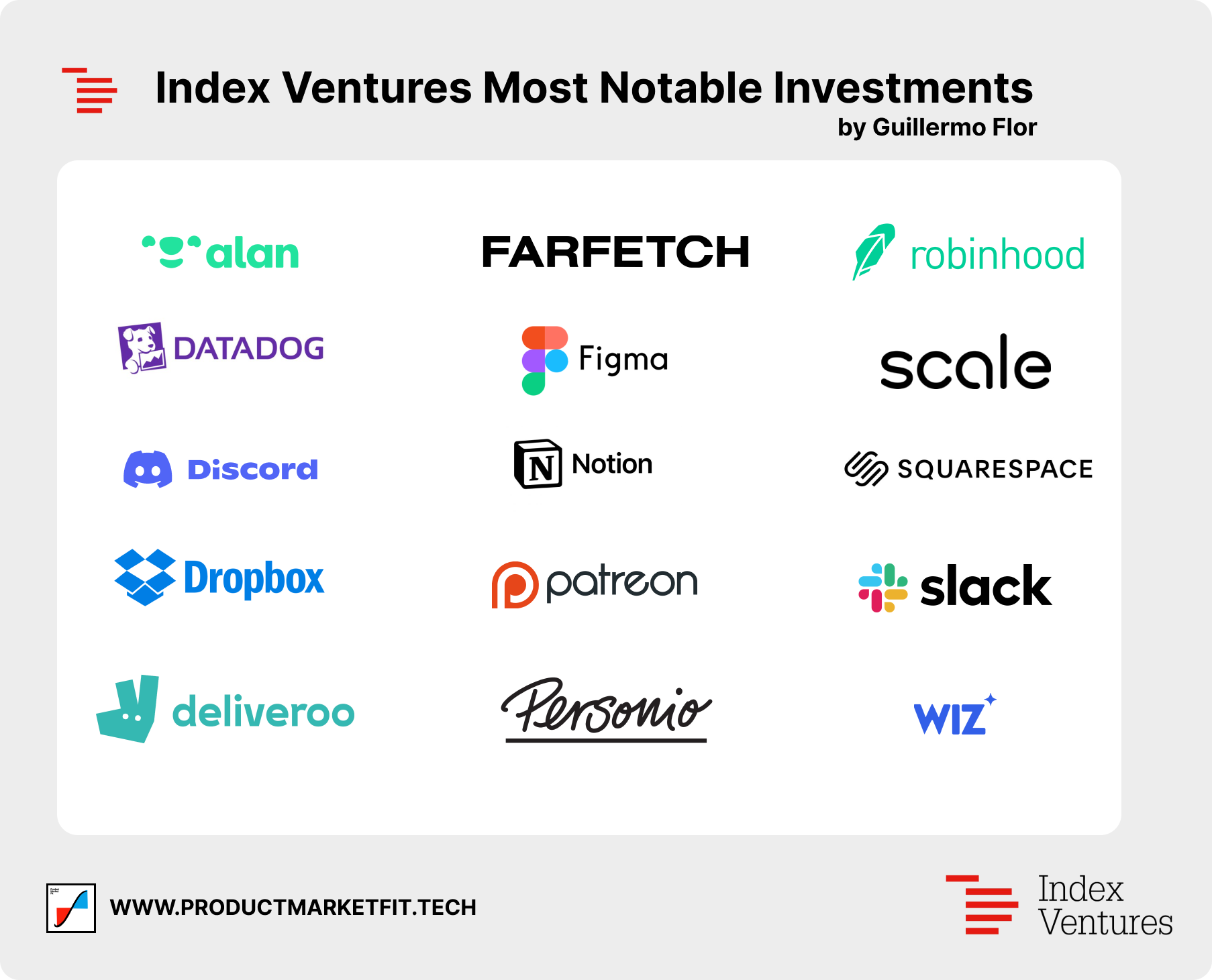

Practical examples of Index Ventures’ impact are evident in the success stories of firms like Dropbox, Slack, Revolut, Roblox, Figma, and Deliveroo.

[ca26zj]

[y7hxll]

These companies, often backed in their formative years, have grown into international leaders, changing the way millions work, communicate, bank, entertain themselves, and even eat. Index’s hands-on approach is a hallmark: the firm not only provides capital but leverages a network of experienced entrepreneurs, advisors, and executives to help founders navigate global expansion and operational challenges.

[ca26zj]

[nen8bj]

Benefits of partnering with Index Ventures include deep sector expertise, access to global markets, and a culture that emphasizes founder relationships over transactional deals.

[nen8bj]

For example, Index Ventures’ involvement in Figma began well before its success, demonstrating long-term commitment and an ability to spot industry-defining potential.

[9bejhk]

There are, however, challenges and considerations. The highly competitive nature of VC means that timing, deal access, and founder-investor fit are critical. Not all companies succeed, and the pressures of hyper-growth demand resilience from both entrepreneurs and investors. Index addresses these risks with a rigorous selection process and continued mentorship.

[jijc3o]

[nen8bj]

Current State and Trends

Today, Index Ventures manages billions in assets and has raised substantial funds in recent years—for instance, $3.1 billion across multiple funds in 2021, spanning early, growth, and seed-stage investments.

[vim3se]

The firm’s influence extends across the US, Europe, and Israel—regions known for diverse and rapidly evolving tech scenes.

[t7xtku]

Key players in the venture capital sector include firms such as Sequoia Capital, Accel, and Andreessen Horowitz, with Index Ventures holding its own through a combination of global perspective and local expertise. Recent trends include greater focus on AI, cybersecurity, fintech, and sustainability—sectors with transformative potential.

[t7xtku]

Future Outlook

The future for Index Ventures points toward continued global expansion, deeper involvement in frontier technologies, and strengthened support for diverse founders. Given the pace of innovation in areas like artificial intelligence, digital health, and financial technology, Index is well positioned to fund the next generation of world-changing companies, potentially reshaping markets and society at large.

Conclusion

Index Ventures stands as a major catalyst for entrepreneurship and innovation in the tech-driven economy, harnessing expertise and capital to power transformative companies. As technology continues to advance, the firm’s role in shaping future trends remains both significant and dynamic.

Citations

[vim3se] 2025, Nov 13. Index Ventures - Wikipedia. Published: 2007-11-09 | Updated: 2025-11-13

[jijc3o] 2025, Oct 26. Index Ventures - Funding - The Hub. Published: 2016-10-04 | Updated: 2025-10-26

[ca26zj] 2025, Nov 10. Index Ventures - Investor Profile & Information - OurCrowd. Published: 2023-04-20 | Updated: 2025-11-10

[t7xtku] 2025, Sep 01. Index Ventures - VC Fund Breakdown. Published: 2022-12-09 | Updated: 2025-09-01

[nen8bj] 2025, Nov 13. Index Ventures | Philosophy. Published: 2011-01-01 | Updated: 2025-11-13

[y7hxll] 2025, Nov 12. Index Ventures | Companies. Updated: 2025-11-12

[9bejhk] 2025, Nov 11. Index Ventures. Updated: 2025-11-11