Venture Capital

(2025-08-16T15:40.534Z)

Perplexity Query

(2025-08-16T15:40

.534Z)

Question:

What are some trends in Venture Capital in the past ten years?

Image References: Please include the following image references throughout your response where appropriate:

Model: sonar-pro

Response from sonar-pro:

Over the past ten years, venture capital (VC) has experienced substantial transformation, marked by dramatic funding cycles, changing geographic dominance, and major shifts in technology focus.

Key Trends in Venture Capital (2015–2025)

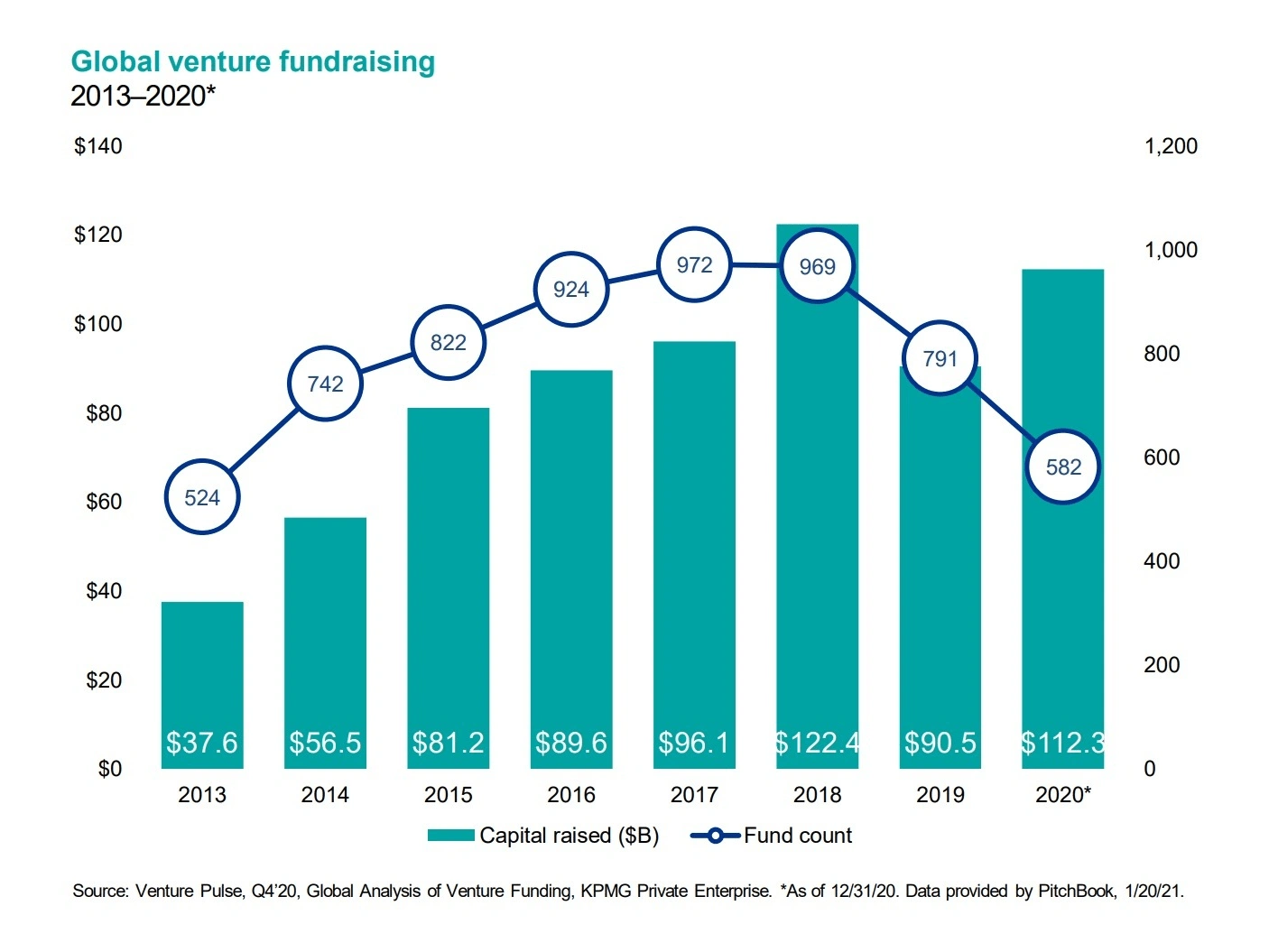

- Surge and Correction in Global VC Funding

- Rapid Growth Period: From 2015 to 2021, global VC investment grew at a 13.5% compound annual growth rate, peaking at unprecedented levels in 2021 (Q2: $157.1bn globally). [2ry2zc]

- Correction Phase: Since late 2022, funding volumes dropped sharply, with a 17% quarter-over-quarter decline noted in Q2 2025. This reflects a normalization after exceptional pandemic-era highs and outlier deals like OpenAI. [6mw8zl]

- Mega-Rounds and Market Volatility

- Rise of Mega-Rounds: Companies raising $100M+ saw an explosion from 111 rounds in 2015 to 859 in 2021, largely driven by interest in pre-IPO tech and life sciences. [16zmha]

- Sudden Drop and Partial Recovery: Count of $100M+ rounds fell dramatically in 2023 but rebounded in 2024, reflecting cyclical investor appetites and macroeconomic conditions. [16zmha]

- Geographic Shifts and Sector Focus

- Asia’s Unique Trajectory: Asia’s VC activity peaked pre-pandemic and remains below Q3 2019 levels, with China subdued but India emerging as a strong spot in fintech and mobility. [6mw8zl]

- Deepening Focus on Technology

- Generative AI and Software: Since 2024, 45% of VC funding concentrated in software and AI—with generative AI showing record growth, particularly in development tools and applied AI. [6mw8zl]

- Evolution in Investment Strategies

- Boutique and Targeted Funds: Growing trend toward boutique or “artisanal” venture firms that focus on early-stage startups, investing smaller amounts with hands-on support and industry expertise, often prioritizing founder relationships and domain expertise over purely financial metrics. [zy1rx1]

- Valuation Corrections: Investors increasingly prefer stronger, more profitable startups, with valuation discipline rising and market “cleanup” underway after the loose practices of the boom period. [zm9oc4]

- Increasing Seed-Stage Deal Sizes: Notable recent seed deals (e.g., $2B round for Thinking Machines show upward pressure on early-stage valuations, even as late-stage averages dip due to correction. [6mw8zl]

- Steady Corporate VC Activity: Corporate VCs have consistently accounted for about 36% of deal value in recent years, reflecting sustained interest in breakthrough technologies and willingness to fund capital-intensive ventures. [6mw8zl]

- Liquidity and Exit Challenges

Additional Insights

- Pandemic Effects: COVID-19 catalyzed a burst of innovation and digitization, further accelerating VC interest in transformative technologies across sectors. [2ry2zc]

- Interest Rate Impact: Recent stability in interest rates and tightening monetary policy have influenced investor risk appetites and contributed to market corrections. [zm9oc4]

Venture capital continues to evolve rapidly, with AI, fintech, and hard tech at the forefront and shifting preferences among investors balancing risk, exit timing, and involvement depth. Frequent cycles of exuberance and pullback suggest a maturing, more disciplined ecosystem in 2025 and beyond.

[zm9oc4]

[6mw8zl]

[2ry2zc]

[16zmha]

Citations

[zy1rx1] 2025, May 04. Transformative Venture Capital Trends In 2025 To Watch For. Published: 2021-07-07 | Updated: 2025-05-04

[zm9oc4] 2025, Mar 15. Venture capital trends 2025: What's changing & why it .... Published: 2025-03-05 | Updated: 2025-03-15

[6mw8zl] 2025, Aug 08. Global Venture Capital Outlook: The Latest Trends. Published: 2025-08-08 | Updated: 2025-08-08

[2ry2zc] 2025, Jun 16. Venture Capital trends | Venture Capital Investing Report. Published: 2023-07-20 | Updated: 2025-06-16

[16zmha] 2025, Aug 16. The Rise and Fall and Rise Again of VC “Mega-Rounds”. Published: 2025-08-15 | Updated: 2025-08-16