Open Innovation

Response from sonar-pro:

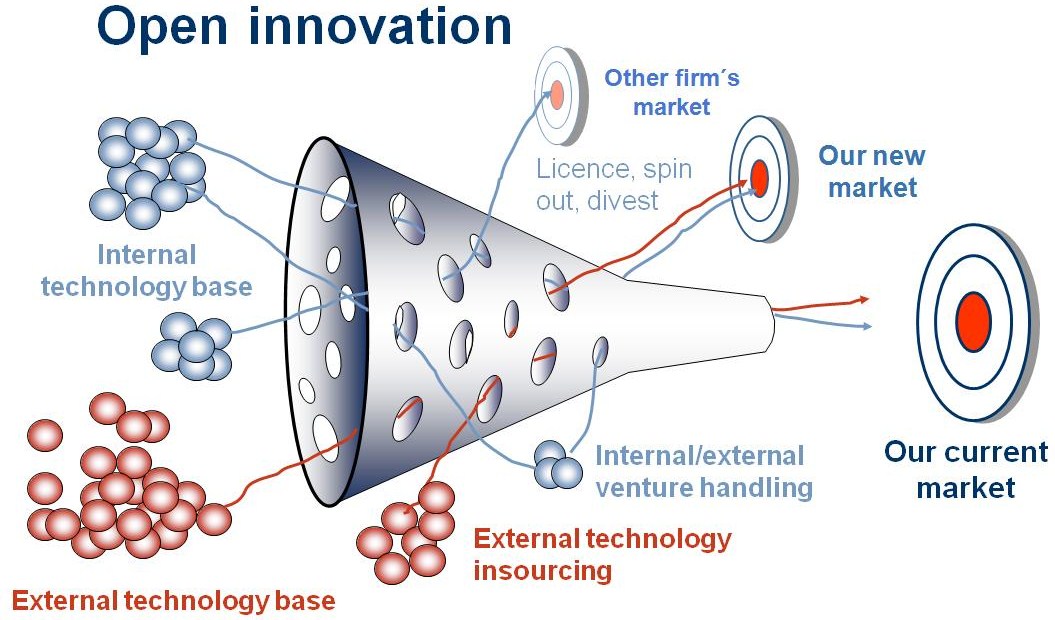

- Inside-Out and Outside-In Flows:

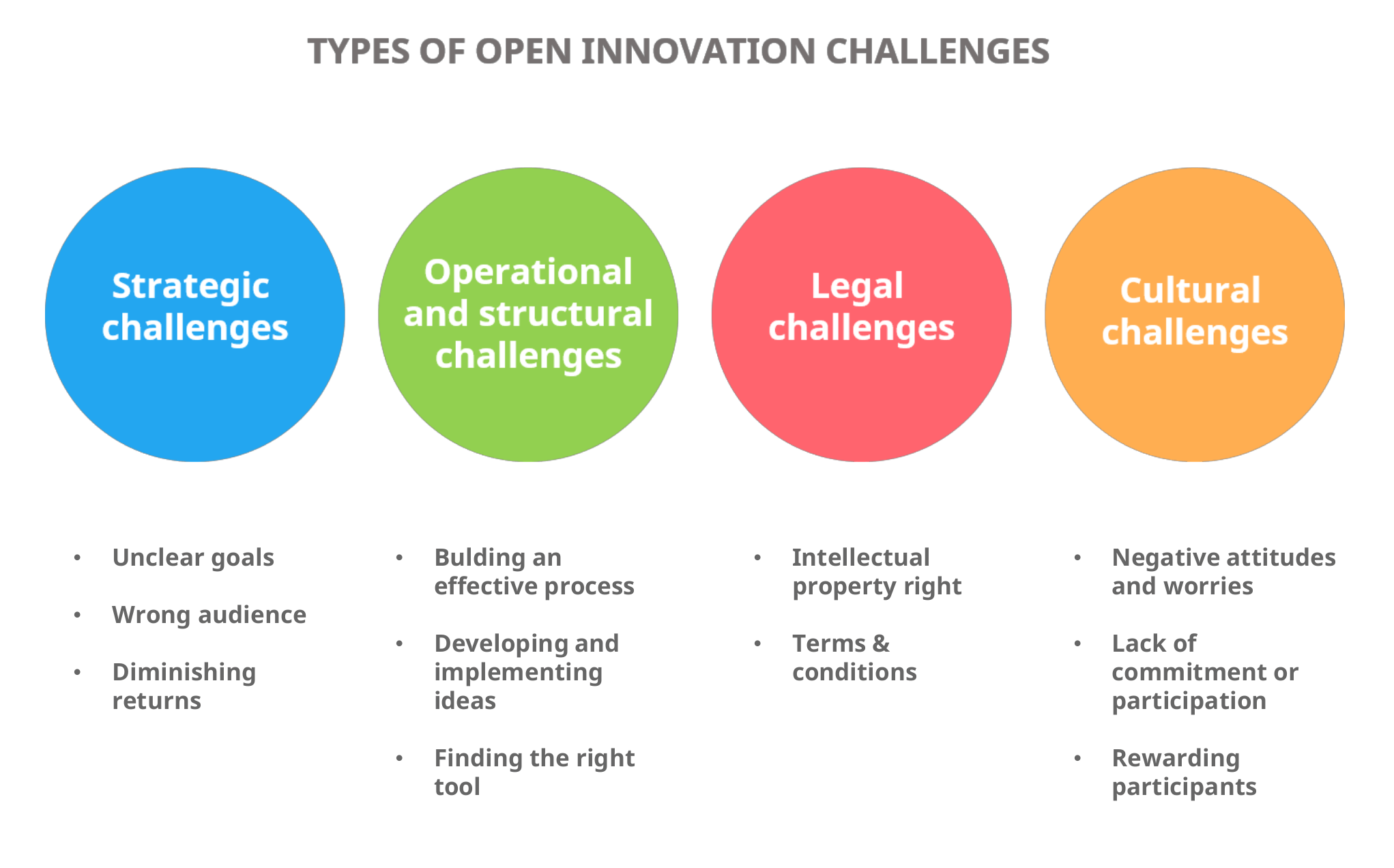

- Trend Management: Companies track and adapt to emerging trends by analyzing external signals and forecasts, ensuring their innovation priorities align with future needs. [7kwpvx]

- Technology Scouting: Systematic search for new technologies around the world, including partnerships with research institutions, attendance at industry events, or collaborating in startup ecosystems. [7kwpvx]

- Innovation Ecosystem: Open Innovation creates a network of collaborators, including alliances, academic partnerships, and open competitions, widening the scope of potential solutions and expertise. [5lmjky]

| Concept | Closed Innovation | Open Innovation |

| Knowledge source | Internal R&D only | Both internal and external sources |

| Collaboration | Rare, mostly within firm | Frequent, with outside partners (companies, universities, etc.) |

| Knowledge flow | Closed: ideas stay inside | Open: purposeful inflow and outflow of knowledge |

| Risk and secrecy | High control, low external risk | Lower control, but greater access to new ideas and perspectives |

- Open Innovation recognizes that not all smart people work for a single organization; valuable ideas and technologies may come from outside.

How the Strategy Aligns with Open Innovation

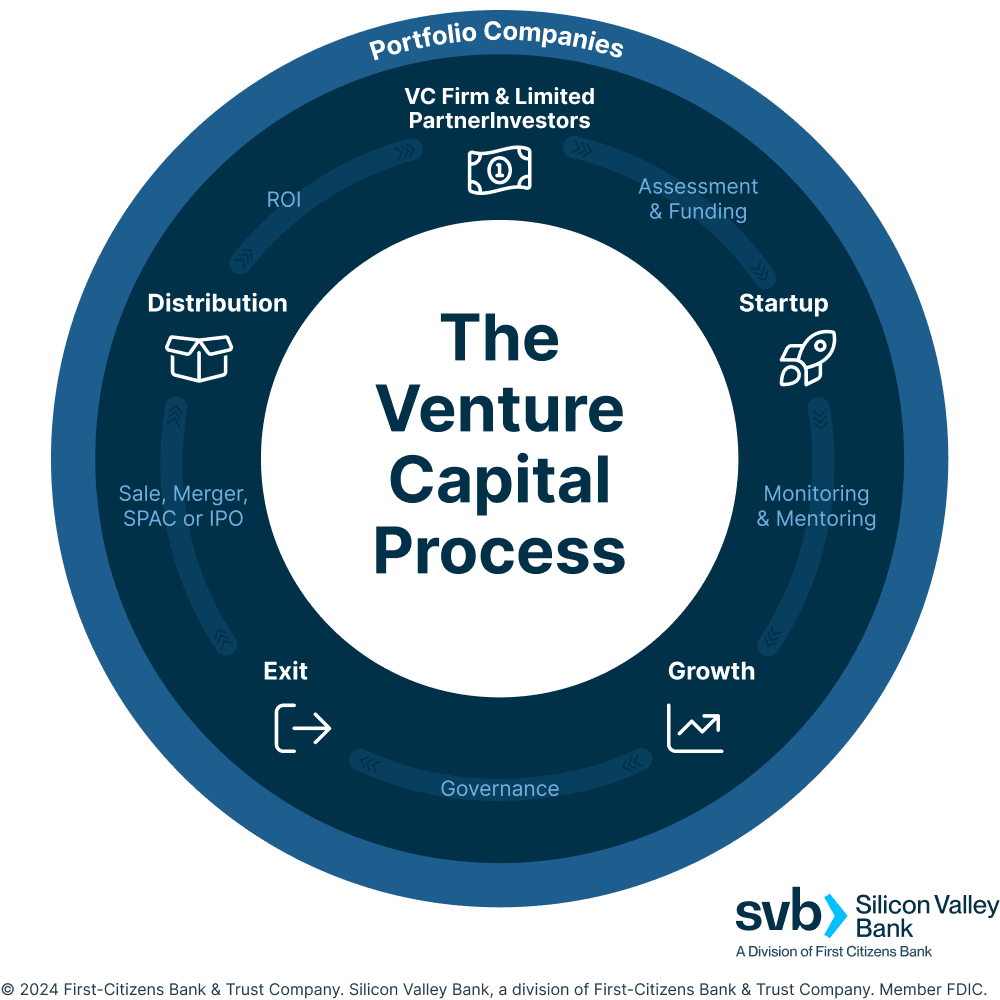

- By investing in Emerging Managers and Solo GPs, you leverage a diverse set of external networks, sourcing unconventional dealflow beyond your direct reach. [snj3us]

- Co-investing in bridge rounds of their portfolio companies ensures active participation in networks of innovation as portfolio companies scale or pivot, amplifying learning and syndication opportunities.

- Discretionary direct investments ensure you retain the ability to harness internal sourcing and proprietary insights, balancing the openness with a tailored thesis.

Diagram showing flow of capital and information from Hypernova to Solo GP funds and onward to portfolio companies, illustrating multiple “innovation entry points” for dealflow.

Diagram showing flow of capital and information from Hypernova to Solo GP funds and onward to portfolio companies, illustrating multiple “innovation entry points” for dealflow.Evidence Supporting the Strategy

- Allocating significant capital to bridge rounds places Hypernova in critical inflection points for startups (between seed extension and Series A/B). [cixfs4]

- Early-stage bridge rounds typically offer strong valuation advantages and access before growth inflection, providing early entry to potential future winners. [cixfs4]

- By being enmeshed in the sourcing and selection of dozens of Solo GPs and managers, Hypernova can aggregate and synthesize proprietary insights, arming itself with a richer qualitative portfolio assessment versus traditional funds. [puijz5]

- This aligns with recent strategic thinking suggesting that fund-of-funds structures can be foundational for exposure, access, and agility in the so-called "Venture 3.0" era. [puijz5]

Visualization showing how Hypernova’s fund interacts with multiple Solo GPs, who then invest in diverse startup sectors, widening Hypernova’s private market intelligence and exposure.

Visualization showing how Hypernova’s fund interacts with multiple Solo GPs, who then invest in diverse startup sectors, widening Hypernova’s private market intelligence and exposure.Why This Can Outperform Typical Early-Stage VC

| Strategy Feature | Open Innovation Benefit | Potential Outperformance |

| Fund-of-Funds Core | Access to diverse networks and deal sources | Unconventional, high-upside deals [snj3us] [qyr1yt] |

| Bridge Round Co-Investment | Strategic entry at high-leverage inflection points | Early, lower valuation, higher return potential [cixfs4] |

| Discretionary Direct Deals | Balance between openness and proprietary edge | Optimize risk/return and thesis-driven plays |

| Active Portfolio Learning | Faster learning from multiple, heterogeneous data points | Agile adaptation, better informed follow-on investments [puijz5] |

Graph comparing typical VC fund returns to those using a fund-of-funds plus bridge round model, with markers for diversification benefit (“Venture Spread”).

[puijz5]

[cixfs4]

Graph comparing typical VC fund returns to those using a fund-of-funds plus bridge round model, with markers for diversification benefit (“Venture Spread”).

[puijz5]

[cixfs4]

Summary of Research and Beliefs

- Positioning capital for co-investment at bridge rounds capitalizes on lower competition and more favorable pricing, consistent with early-stage VC’s highest upside opportunity zones. [cixfs4]

- Discretionary allocation gives Hypernova flexibility to exploit proprietary dealflow and test emergent theses, ensuring continued relevance as markets shift. [puijz5]

Citations

[oh658w] 2025, Aug 06. What is Open Innovation? Definition, Types, Model and Best Practices. Published: 2025-05-06 | Updated: 2025-08-06

[7kwpvx] 2025, May 08. What is Open Innovation? Benefits & Best Practices - Qmarkets. Published: 2024-12-24 | Updated: 2025-05-08

[5lmjky] 2025, Jun 15. Open Innovation: Definition and Types of Innovation - Ennomotive. Published: 2020-02-25 | Updated: 2025-06-15

[verg9d] 2025, Aug 06. Open Innovation Basics - NineSigma. Updated: 2025-08-06

[hqxm84] 2025, May 03. Open Innovation - Definitions, Benefits and Examples. Published: 2020-08-13 | Updated: 2025-05-03

[snj3us] 2025, Nov 07. How The Best LPs Evaluate Emerging VC Fund Managers. Published: 2025-10-02 | Updated: 2025-11-07

[zn7nlf] 2025, Nov 22. The Basics of Venture Capital - VC Lab. Published: 2023-11-29 | Updated: 2025-11-22

[puijz5] 2025, Jun 07. Rethinking Venture Capital - A Strategic Lens (Public Version). Published: 2025-06-07 | Updated: 2025-06-07

[cixfs4] 2025, Nov 07. Early-Stage Venture Capital: The Next Great Alternative Investment .... Published: 2025-05-14 | Updated: 2025-11-07

[qyr1yt] 2025, Nov 07. Deep Dive: Intro to Fund of Funds - VC Stack. Published: 2024-01-15 | Updated: 2025-11-07

[3gqesl] 2025, Nov 20. The Non-Obvious Emerging LP Playbook. Published: 2022-10-13 | Updated: 2025-11-20