Double Differentiation

(2025-08-12T03:28.430Z)

Perplexity Query

(2025-08-12T03:28

.430Z)

Question:

Write a comprehensive one-page article about "Double Differentiation, in relation to startups".

Structure the article as follows:

- Introduction (2-3 sentences)

- Define the term and its significance

- Provide context for why it matters

- Main Content (3-4 paragraphs)

- Explain the concept in detail

- Include practical examples and use cases

- Discuss benefits and potential applications

- Address any challenges or considerations

- Current State and Trends (1-2 paragraphs)

- Discuss current adoption and market status

- Mention key players or technologies

- Highlight recent developments

- Future Outlook (1 paragraph)

- Predict future developments

- Discuss potential impact

- Conclusion (1-2 sentences)

- Summarize key points

- End with a forward-looking statement

Important Guidelines:

- Keep the total length to approximately one page (500-800 words)

- Use clear, accessible language

- Include specific examples and real-world applications

- Make it engaging and informative for a general audience

- Use markdown formatting for structure

Image References:

Include

after the introduction.

Include

after the main content section.

Include

before the conclusion.

Replace "Double Differentiation, in relation to startups" with the actual vocabulary term in the prompt.

Model:

sonar-pro

Response from sonar-pro:

Double differentiation in startups

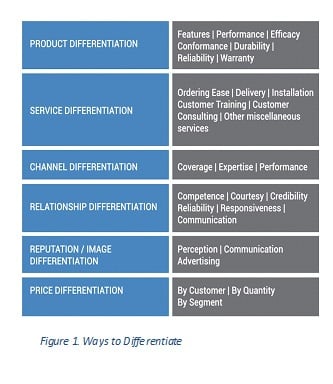

- Introduction Double differentiation is a go-to-market and product strategy where a startup deliberately differentiates on two distinct axes—typically product and business model, or product and distribution—so it’s not only better, but also different in more than one meaningful way. It matters because single-axis differentiation is easy for incumbents to copy, while layered differentiation compounds defensibility and accelerates fit with a specific market wedge. In practice, this often blends product uniqueness with pricing, packaging, or a distinct channel play to create separation that’s hard to close. [draer6]

- Main Content At its core, double differentiation pairs a clear product “why us” with a complementary “how we win” in the market. The first axis is usually functional (e.g., a novel workflow, faster performance, proprietary data), and the second is commercial (e.g., pricing model, product mix, captive complements, or a unique distribution loop). For example, a startup might offer a simpler shared-inbox product targeted at SMB service teams (product axis) and pair it with a product-led, low-friction pricing bundle that undercuts incumbents while monetizing add-ons (business model axis). This combination makes direct feature imitation insufficient; the challenger also competes on packaging and economics. [draer6]

Practical examples:

- Hardware-plus-consumables: A company prices the core device aggressively but drives durable margins via a complementary, recurring component—classic captive-product pricing. The product is approachable and slick; the revenue model is recurring and defensible. This dual play scales quickly if customers perceive ongoing value and not lock-in abuse. [draer6]

- Data network effects + niche wedge: A startup enters with a narrowly scoped, underserved use case that generates proprietary data improving the service over time (product axis) and focuses distribution on communities or ecosystems incumbents ignore (distribution axis). This “pick” from founder experience frequently produces crisp, credible wedges that incumbents miss until it’s too late. [vbzf5y]

Benefits and applications:

- Stronger defensibility: Competing on two fronts raises imitation costs—copying features without the economic model (or vice versa) rarely recreates the same moat. [draer6]

- Faster market traction: Tighter pricing/packaging can unlock adoption even when the product is only modestly better, and a distinct product unlocks delight even when pricing is similar; together, they compound.

- Better unit economics over time: Product mix strategies (e.g., add-ons, by-products) can improve margins and resilience across customer cohorts. [draer6]

Challenges and considerations:

- Execution complexity: Coordinating product innovation with pricing/packaging and channel learning curves can strain early teams; misalignment risks confusing customers. [draer6]

- Perceived lock-in: Captive or proprietary complements can trigger backlash if value isn’t obvious and ongoing; transparent value and fair pricing are essential. [draer6]

- Focus risk: Chasing two axes must still serve a tight market wedge; overextension dilutes signal. Founders often succeed when the second axis deepens the initial wedge discovered through lived experience. [vbzf5y]

- Current State and Trends Current adoption is rising as crowded categories make single-feature advantages fleeting. Founders increasingly combine product-led growth with creative packaging (modular bundles, usage tiers) and ecosystem tactics (partner channels, communities) to stand out. Product mix pricing—captive complements, add-ons, and even monetized by-products—is spreading from consumer hardware to SaaS and fintech as teams tune for growth and margin simultaneously. [draer6]

Key players and practices:

- Fintech and B2B SaaS frequently pair an opinionated product with novel pricing or a wedge sourced from founder experience—an origin pattern visible in stories like Coinbase (seeing a system-level gap, then building a distinct on-ramp and business model). [vbzf5y]

- Payments and platforms promote pricing architectures that encourage attach rates and lock in value, illustrating how business-model design has become a first-class differentiation lever alongside product design. [draer6]

- Future Outlook Expect double differentiation to become a default design principle: startups will engineer moats by intertwining proprietary data or workflow depth with inventive monetization and distribution blueprints, while treating pricing architecture as product. As capital efficiency pressures persist, strategies like captive complements, ecosystem partnerships, and wedge-first GTM will reward teams that align product choices with durable, customer-trusted economics. [draer6] [vbzf5y]

- Conclusion Double differentiation helps startups escape commodity traps by pairing product distinctiveness with a reinforcing business model or channel strategy. Teams that architect both axes around a specific wedge—and sustain clear, fair value—will set the pace in increasingly competitive markets. [draer6] [vbzf5y]

Footnotes

[vbzf5y] : 2025, Aug 05. PMF Playbook: Chapter II – The Pick. Published: 2025-08-06 | Updated: 2025-08-06

[draer6] : 2025, Jul 29. Product mix pricing strategies for growth. Published: 2025-07-29 | Updated: 2025-07-30