Behavioral Economics

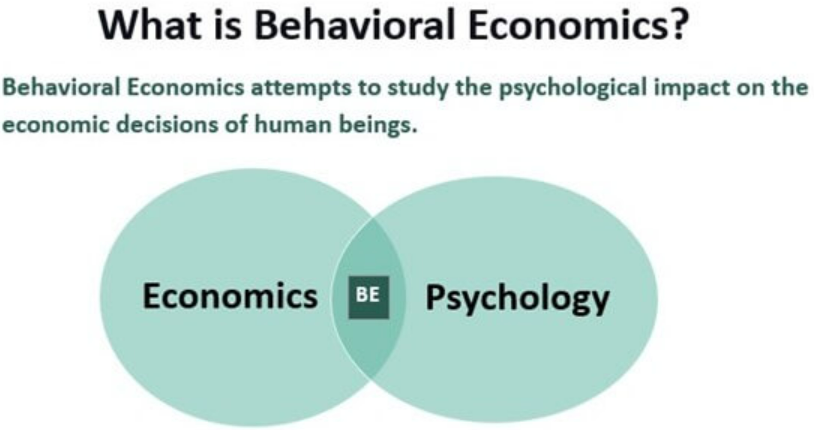

Behavioral economics examines how psychological factors shape economic decisions, showing that people often deviate from the “rational actor” assumptions of traditional models

[mdt4m5]

. It matters because these predictable deviations influence markets, public policy, and everyday choices—from saving and investing to health and consumer behavior

[9z67e0]

.

Introduction

Behavioral economics is the interdisciplinary study of how cognition, emotions, social influences, and heuristics affect choices by individuals and institutions, often leading to systematic departures from rational choice theory

[mdt4m5]

. By integrating insights from psychology and neuroscience with economics, it offers more realistic models of decision-making and tools to design better products, policies, and services

[9z67e0]

.

Main Content

At its core, behavioral economics documents consistent patterns—such as bounded rationality, loss aversion, present bias, overconfidence, framing effects, and reliance on heuristics—that explain why choices may be “predictably irrational” relative to classical expectations

[9z67e0]

[mdt4m5]

. For example, people may satisfice (choose a “good enough” option) rather than optimize when searching is costly, or use elimination-by-aspects to narrow options by key attributes

[mdt4m5]

.

Practical examples abound. “Nudge” interventions—like default enrollment in retirement plans—increase participation and savings by leveraging inertia and status quo bias without limiting choice

[9z67e0]

. Marketers use framing and anchoring to shape perceived value, such as presenting a “decoy” option to steer preferences. Public health campaigns apply social norms (e.g., “most of your neighbors recycle”) to encourage pro-social behaviors. In finance, behavioral biases like herd behavior and overconfidence help explain momentum and mispricing observed by behavioral finance researchers

[vgjsa9]

[9z67e0]

.

The benefits are significant. Organizations can boost uptake of beneficial choices (savings, vaccinations) and improve user experience by simplifying choices and aligning with human tendencies

[9z67e0]

. Policymakers can design choice architectures—defaults, reminders, timely prompts—that achieve outcomes more efficiently than mandates. Businesses can refine pricing, product design, and communication to reduce friction and decision errors, improving satisfaction and retention

[yjc93z]

[9z67e0]

.

However, there are challenges. Nudges can raise ethical concerns about paternalism and transparency; best practice emphasizes disclosure and alignment with users’ interests. Effects may be context-dependent, with some interventions failing to replicate across settings. Overreliance on heuristics can backfire if environments change, and poorly designed defaults can entrench suboptimal outcomes. Rigorous testing and ongoing measurement are essential to ensure impact and avoid unintended consequences

[9z67e0]

[mdt4m5]

.

Current State and Trends

Adoption is widespread across governments (behavioral insights teams), financial services, technology platforms, health systems, and consumer marketing, where A/B testing and experimentation embed behavioral design into product and policy cycles

[9z67e0]

. Key concepts—nudging, framing, defaults, and social norms—are mainstream in retirement plan design, tax compliance prompts, and digital onboarding flows

[9z67e0]

[yjc93z]

.

Notable contributors include Daniel Kahneman, Amos Tversky, and Richard Thaler, whose work on prospect theory, heuristics, and nudging catalyzed the field; in industry, behavioral insights units and product growth teams operationalize these ideas at scale. Behavioral finance remains a prominent subfield, emphasizing limits to arbitrage and psychological drivers of markets

[vgjsa9]

. Recent developments include scaling personalized nudges via digital platforms, and using search heuristics and simplified choice architectures to reduce cognitive load in complex decisions

[mdt4m5]

[vgjsa9]

.

Future Outlook

Expect deeper integration with data science and AI to deliver context-aware, real-time nudges; more rigorous, transparent evaluation standards; and broader applications in climate action, cybersecurity, and healthcare adherence, pairing ethical frameworks with behavioral design to achieve measurable, user-aligned outcomes at scale

[9z67e0]

[vgjsa9]

[mdt4m5]

.

Conclusion

Behavioral economics enriches economic thinking with psychological realism, enabling more effective policies, products, and financial decisions

[9z67e0]

[mdt4m5]

. As tools and evidence mature, its influence will grow—shaping systems that work with, not against, how people actually think and choose

[vgjsa9]

.

(2025-08-12T03:45.138Z)

Perplexity Query

(2025-08-12T03:45

.138Z)

Question:

Write a comprehensive one-page article about "Behavioral Economics".

Structure the article as follows:

- Introduction (2-3 sentences)

- Define the term and its significance

- Provide context for why it matters

- Main Content (3-4 paragraphs)

- Explain the concept in detail

- Include practical examples and use cases

- Discuss benefits and potential applications

- Address any challenges or considerations

- Current State and Trends (1-2 paragraphs)

- Discuss current adoption and market status

- Mention key players or technologies

- Highlight recent developments

- Future Outlook (1 paragraph)

- Predict future developments

- Discuss potential impact

- Conclusion (1-2 sentences)

- Summarize key points

- End with a forward-looking statement

Important Guidelines:

- Keep the total length to approximately one page (500-800 words)

- Use clear, accessible language

- Include specific examples and real-world applications

- Make it engaging and informative for a general audience

- Use markdown formatting for structure

Image References:

Include [IMAGE 1: Behavioral Economics concept diagram or illustration] after the introduction.

Include [IMAGE 2: Behavioral Economics practical example or use case] after the main content section.

Include [IMAGE 3: Behavioral Economics future trends or technology visualization] before the conclusion.

Replace "Behavioral Economics" with the actual vocabulary term in the prompt.

Model:

sonar-pro

Response from sonar-pro:

Footnotes

[mnh39u] 2025, Jul 28. Behavioral Economics: The Psychology of Decisions. Published: 2025-07-30 | Updated: 2025-07-29

[9z67e0] : 2025, Jul 23. Behavioral Economics: Meaning, Principles, Application .... Published: 2025-07-23 | Updated: 2025-07-24

[vgjsa9] : 2025, Jul 29. Behavioral Economics: The Psychology of Choice. Published: 2025-07-23 | Updated: 2025-07-30

[mdt4m5] : 2025, Aug 09. Behavioral economics. Published: 2025-07-22 | Updated: 2025-08-10

[yjc93z] : 2025, Apr 11. What Is Behavioral Economics? Definitive Guide To .... Published: 2025-07-24 | Updated: 2025-04-12