Class5 Global

(2025-09-26T17:19.988Z)

Perplexity Query

(2025-09-26T17:19

.988Z)

Question:

Write a comprehensive one-page article about "Class5 Global Venture Capital Firm and Strategy".

Model: sonar-pro

Class 5 Global Venture Capital Firm and Strategy

Class 5 Global is a San Francisco-based venture capital (VC) firm established in 2018, specializing in early-stage investments across a range of technology sectors and global markets. As a rapidly emerging player, Class 5 Global holds particular significance for startups seeking not just capital, but also strategic guidance and access to a worldwide network of entrepreneurs and investors.

[ud14b0]

[mirt0d]

This firm matters because it embodies the increasing globalization of venture capital—actively identifying and supporting high-potential startups far beyond Silicon Valley, thereby shaping the future of innovation ecosystems around the world.

Main Content

Class 5 Global’s investment strategy is rooted in building long-term partnerships with founders and leveraging deep cross-border experience. The firm positions itself fundamentally as “in the people business,” emphasizing that strong relationships with visionary entrepreneurs are the key drivers of its success.

[3ou0ga]

[wzucd7]

Unlike firms focused only on financial returns, Class 5 Global invests heavily in founder support—helping portfolio companies grow with operational guidance, access to expert networks, and introductions to later-stage investors.

Class 5 Global’s typical investment stages include pre-seed, seed, and early growth rounds, generally targeting startups with valuations in the $10–50 million range and an average startup age of three years at the time of investment.

[ud14b0]

Their mandate is notably international, with investments spanning North America, Latin America, the Middle East, Africa, Asia, and Australia.

[3ou0ga]

Frequently, the firm joins syndicated rounds with other globally recognized VCs, such as Thrive Capital, ZhenFund, and Vy Capital, further amplifying portfolio companies' access to resources and follow-on funding.

[ud14b0]

Practical examples and use cases of the Class 5 Global strategy include backing transformative companies like:

- Careem, the leading Middle Eastern ride-sharing platform, which was acquired by Uber for $3.1 billion and serves over 30 million users across 120 cities.

- Meliuz, a cashback service facilitating shopping experiences for over 10 million users in Latin America, which went public in 2020.

- Fresha, a merchant platform for beauty and wellness services, supporting more than 80,000 businesses and facilitating over 600 million appointments globally. [wzucd7]

These cases highlight Class 5 Global’s ability to identify “next-generation global entrepreneurs” and scale local solutions to international relevance.

The benefits and potential applications of Class 5 Global’s model include:

- Accelerated international market entry for startup founders.

- Access to seasoned VC partners with diverse global experience.

- Strong syndication networks for capital efficiency and de-risking investments.

However, the approach is not without challenges. Investing across disparate legal, regulatory, and cultural landscapes can lead to complexities in due diligence, portfolio management, and post-investment support. Furthermore, balancing speed of capital deployment with high conviction decisions—a hallmark of competitive early-stage investing—requires robust processes and experienced judgment.

[ud14b0]

[3ou0ga]

Current State and Trends

As of 2024, Class 5 Global remains an active and growing force in early-stage venture, with more than 30 investments and a strategy that regularly involves 2–6 deals per year.

[ud14b0]

Their industry footprint spans fintech, software, e-commerce, electric vehicles, and real estate, with a particular concentration of activity in the United States, Middle East, and emerging markets across Africa and Latin America.

[ud14b0]

[95okuf]

Notable recent deals include investments in software and procurement startups like Penny in Saudi Arabia and mobility platforms in Singapore.

[ud14b0]

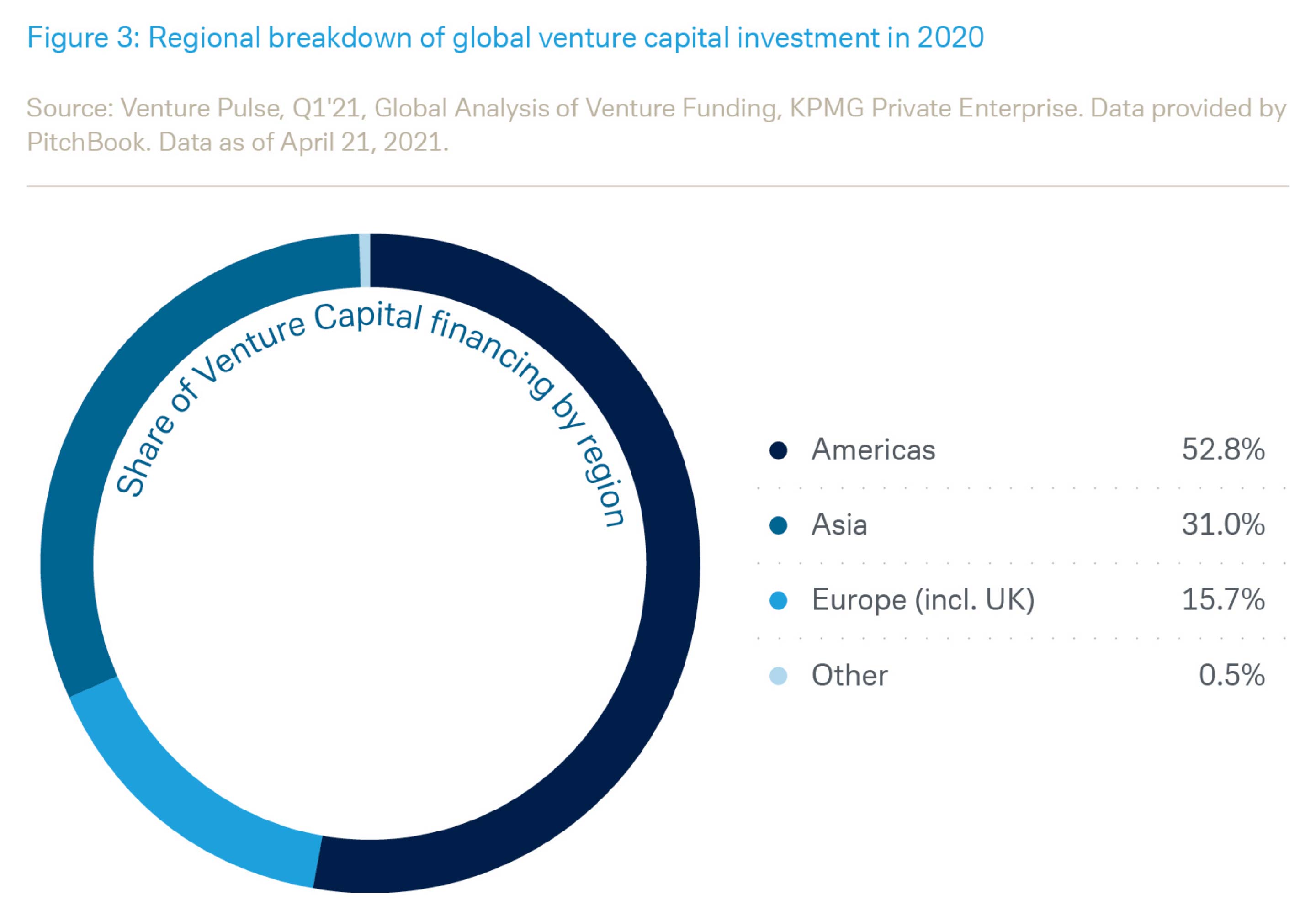

Key trends shaping the global VC landscape, and reflected in Class 5 Global’s strategy, include:

- An increasing appetite for cross-border syndication and multi-region funds.

- Expanding focus on sectors enabled by digital transformation (e.g., SaaS, fintech, ride-sharing).

- Growing competition among VCs for high-potential founders and early-stage deals.

Future Outlook

Looking ahead, the global venture capital market is expected to become even more interconnected, with firms like Class 5 Global driving innovation hubs in regions historically underserved by venture funding. Advances in digital infrastructure, international regulatory harmonization, and remote deal sourcing are poised to lower barriers, facilitating a new wave of globally scaled startups. Class 5 Global’s combination of founder-centric philosophy, deep network reach, and early-mover advantage positions it for continued impact as technology entrepreneurship globalizes.

Conclusion

Class 5 Global exemplifies the modern venture capital firm—global in reach, agile in strategy, and focused on empowering the world’s most promising entrepreneurs. As technology ecosystems grow increasingly connected, such global VC strategies are primed to unlock unprecedented innovation and cross-market growth opportunities.

[wzucd7]

[ud14b0]

Citations

[ud14b0] 2025, Sep 05. Class 5 Global – Investors Database - Unicorn Nest. Published: 2021-11-01 | Updated: 2025-09-05

[3ou0ga] 2025, Sep 02. Class 5 Global - Private Equity List. Published: 2018-01-01 | Updated: 2025-09-02

[wzucd7] 2025, Sep 15. Class 5 Global. Published: 2021-01-01 | Updated: 2025-09-15

[mirt0d] 2025, Sep 18. Class 5 Global | Institution Profile - Private Equity International. Published: 2023-12-04 | Updated: 2025-09-18

[95okuf] 2025, Sep 10. Class 5 Global - Venture Capital Profile & Funded Startups - YNOS. Updated: 2025-09-10